- Category

- >Financial Analytics

- >Machine Learning

How Is Predictive Analytics Used In Finance?

- Soumalya Bhattacharyya

- Jun 23, 2023

Predictive analytics has become a game-changer for businesses across different industries, and finance is no exception. In recent years, financial institutions have increasingly adopted predictive analytics techniques to make better-informed decisions and stay ahead of the competition. Predictive analytics involves the use of data, statistical algorithms, and machine learning techniques to identify patterns and predict future outcomes.

In finance, predictive analytics is particularly valuable as it can help institutions forecast market trends, identify potential opportunities, and mitigate risks. By leveraging historical data and advanced modeling techniques, financial institutions can gain insights into customer behavior, market trends, and economic indicators. These insights can be used to optimize operations, improve customer experiences, and generate higher profits.

Moreover, predictive analytics can help financial institutions make informed investment decisions and allocate resources effectively. It can also be used to identify potential fraudulent activities and prevent financial losses. With predictive analytics, financial institutions can anticipate future outcomes and take preemptive actions to minimize risks and maximize returns.

This article will delve deeper into predictive analytics in finance, exploring its various applications, benefits, and challenges. We will also discuss some real-world examples of financial institutions using predictive analytics to drive growth and stay competitive.

What is predictive analytics in finance?

Predictive analytics in finance refers to the use of statistical methods, data mining, and machine learning techniques to forecast future financial events and trends. This approach involves the analysis of historical data to identify patterns and relationships that can be used to make predictions about future outcomes.

The goal of predictive analytics in finance is to help financial institutions make better-informed decisions, reduce risks, and identify potential opportunities for growth. By using predictive models, financial institutions can anticipate future outcomes and take preemptive actions to minimize risks and maximize returns. It provides insights into customer behavior, market trends, and economic indicators, allowing institutions to optimize their operations, improve customer experiences, and generate higher profits.

Predictive analytics is used in finance across a wide range of applications, including credit risk management, fraud detection, customer segmentation, and investment analysis. For example, credit risk management involves assessing the creditworthiness of borrowers to determine the likelihood of default. Predictive analytics can be used to analyze a wide range of variables, such as payment history, credit utilization, and demographic information, to predict the likelihood of default and make informed decisions about extending credit.

Similarly, fraud detection involves analyzing large volumes of data to identify patterns that may indicate fraudulent activity. Predictive analytics can be used to detect anomalies and identify potential cases of fraud, allowing financial institutions to take proactive steps to prevent financial losses.

In customer segmentation, predictive analytics is used to group customers into different segments based on their behavior and preferences. This allows financial institutions to tailor their products and services to specific customer groups and improve customer experiences.

In investment analysis, predictive analytics is used to identify potential investment opportunities and forecast market trends. This allows financial institutions to make informed investment decisions and allocate resources effectively.

However, there are some challenges associated with predictive analytics in finance, including data quality issues, model complexity, and regulatory compliance. Ensuring data quality is essential for accurate predictions, and financial institutions must also ensure that their models comply with regulatory requirements.

Predictive analytics in finance is a powerful tool that enables financial institutions to make data-driven decisions and stay ahead of the competition. By leveraging historical data and advanced modeling techniques, financial institutions can gain valuable insights into customer behavior, market trends, and economic indicators, allowing them to optimize their operations, improve customer experiences, and generate higher profits.

Top 3 predictive analytics models in finance

While there are various predictive analytics models used in finance, the three models mentioned, are also commonly used. Here is a brief description of each:

-

Classification Model: A classification model is a type of machine learning model used in finance to classify data into different categories or groups. In credit scoring, for example, a classification model can be used to categorize borrowers into low, medium, or high-risk groups based on factors such as payment history, credit utilization, and other demographic factors. The model can then be used to determine the interest rate and other terms of a loan.

-

Outliers Model: An outliers model is used to identify unusual or anomalous data points that do not fit into the normal pattern of a dataset. In finance, an outlier model can be used to detect unusual trading activity, fraudulent transactions, or other anomalies that may indicate a problem. By identifying and investigating these outliers, financial institutions can take proactive steps to prevent financial losses.

-

Time Series Model: A time series model is used to analyze data over time to identify patterns and make predictions about future trends. In finance, time series models can be used to forecast market trends, identify potential investment opportunities, and make informed investment decisions. For example, a time series model can be used to analyze stock prices over time and predict future performance.

Overall, these three predictive analytics models are widely used in finance and have proven to be effective in helping financial institutions make better-informed decisions, mitigate risks, and identify potential opportunities for growth.

Benefits of predictive analytics in Finance

Predictive analytics is an advanced statistical method that uses data, algorithms, and machine learning to predict future events or behaviors. In finance, predictive analytics offers a range of benefits that enable financial institutions to make better-informed decisions, reduce risks, and identify potential opportunities for growth. Here are some of the main benefits of predictive analytics in finance:

-

Risk Mitigation:

Predictive analytics can help financial institutions identify and mitigate risks. For example, in credit risk management, predictive analytics can be used to assess the creditworthiness of borrowers, predict the likelihood of default, and make informed decisions about extending credit. Similarly, in fraud detection, predictive analytics can help identify patterns of fraudulent activity, enabling financial institutions to take proactive steps to prevent financial losses.

-

Improved Customer Experience:

Predictive analytics can help financial institutions personalize their products and services to meet the unique needs of each customer. By analyzing customer data, financial institutions can identify patterns and preferences and tailor their products and services to specific customer groups. This can lead to increased customer satisfaction, loyalty, and retention.

-

Increased Efficiency and Accuracy:

Predictive analytics can automate many manual processes, improving efficiency and reducing errors. For example, in loan underwriting, predictive analytics can automate the process of assessing a borrower's creditworthiness, reducing the time and resources required for manual credit assessments.

-

Improved Investment Decisions:

Predictive analytics can help financial institutions make informed investment decisions. By analyzing economic indicators, market trends, and company financial data, financial institutions can identify potential investment opportunities and forecast market trends. This allows financial institutions to allocate resources effectively and maximize returns.

-

Regulatory Compliance:

Predictive analytics can help financial institutions comply with regulatory requirements. By analyzing data and identifying potential risks, financial institutions can ensure that their operations comply with regulations and avoid penalties.

-

Competitive Advantage:

By leveraging predictive analytics, financial institutions can gain a competitive advantage. Predictive analytics can help financial institutions identify market trends, customer needs, and potential opportunities for growth, enabling them to stay ahead of the competition.

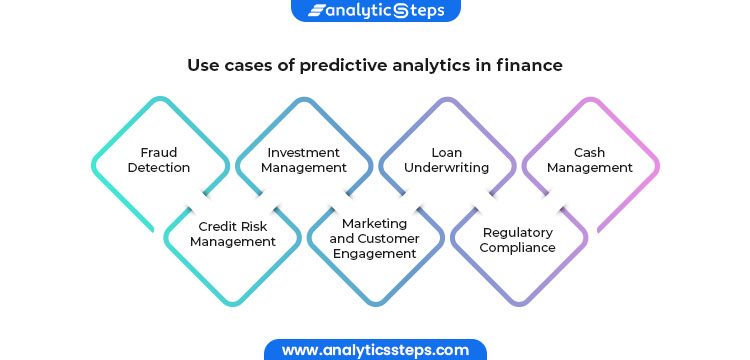

Use cases of predictive analytics in finance:

Predictive analytics is a valuable tool for financial institutions, offering a range of use cases that enable institutions to gain insights, reduce risks, and make more informed decisions. Here are some of the most common use cases of predictive analytics in finance:

Use cases of predictive analytics in finance

-

Fraud Detection:

Predictive analytics can help detect fraud by analyzing data to identify patterns of fraudulent activity. By analyzing transaction data, financial institutions can identify suspicious behavior, such as large transactions or transactions made at unusual times of the day. Predictive analytics can also be used to identify emerging fraud trends and prevent fraud before it occurs.

-

Credit Risk Management:

Predictive analytics can help financial institutions assess the creditworthiness of borrowers and predict the likelihood of default. By analyzing data such as payment history, credit utilization, and other demographic factors, financial institutions can make informed decisions about extending credit.

Also read | Credit Risk

-

Investment Management:

Predictive analytics can be used to analyze economic indicators, market trends, and company financial data to identify potential investment opportunities and forecast market trends. This allows financial institutions to allocate resources effectively and maximize returns.

-

Marketing and Customer Engagement:

Predictive analytics can help financial institutions personalize their marketing efforts and engage with customers more effectively. By analyzing customer data, financial institutions can identify patterns and preferences and tailor their products and services to specific customer groups. This can lead to increased customer satisfaction, loyalty, and retention.

Also read | Marketing Analytics Overview

-

Loan Underwriting:

Predictive analytics can be used to automate the process of assessing a borrower's creditworthiness, reducing the time and resources required for manual credit assessments. This can improve efficiency and reduce errors.

-

Regulatory Compliance:

Predictive analytics can help financial institutions comply with regulatory requirements by analyzing data and identifying potential risks. This allows financial institutions to ensure that their operations comply with regulations and avoid penalties.

-

Cash Management:

Predictive analytics can be used to forecast cash flows, enabling financial institutions to optimize their cash management strategies. By predicting cash flows, financial institutions can ensure that they have sufficient cash on hand to meet their obligations and maximize returns on excess cash.

Future of predictive analytics in Finance:

The future of predictive analytics in finance is bright, with new developments in technology and machine learning that will enable financial institutions to gain even more insights and make even more informed decisions.

As the amount of data generated by financial institutions continues to grow, predictive analytics will become even more important for gaining insights and making informed decisions. Financial institutions will need to invest in tools and technologies that enable them to analyze large volumes of data quickly and accurately.

Artificial intelligence (AI) is rapidly evolving and is likely to play an increasingly important role in predictive analytics. AI can be used to analyze data more quickly and accurately than humans, enabling financial institutions to gain insights and make decisions in real time.

The Internet of Things (IoT) is a network of connected devices that can be used to gather data and provide insights. In finance, IoT devices can be used to gather data on transactions, customer behavior, and other factors that can be used to inform predictive analytics.

In the future, financial institutions will continue to focus on improving customer experience through personalized products and services. Predictive analytics will be a critical tool for achieving this, enabling financial institutions to analyze customer data and tailor their products and services to meet the unique needs of each customer.

Predictive analytics will enable financial institutions to automate many manual processes, reducing the time and resources required for tasks such as credit assessment, fraud detection, and investment management.

Conclusion

In conclusion, predictive analytics is a powerful tool that is transforming the financial industry. By leveraging machine learning algorithms and advanced data analytics, financial institutions can gain insights, reduce risks, and make more informed decisions. Predictive analytics has a wide range of applications in finance, from fraud detection and credit risk management to investment management and customer engagement.

As the financial industry continues to evolve, predictive analytics will become even more important for financial institutions. By embracing new technologies and data sources, financial institutions can gain a competitive advantage and meet the evolving needs of their customers. The future of predictive analytics in finance is bright, with new developments in technology and machine learning that will enable financial institutions to gain even more insights and make even more informed decisions.

It is clear that predictive analytics is a valuable tool for financial institutions seeking to gain a competitive edge in a rapidly changing marketplace. Financial institutions that embrace predictive analytics will be better positioned to manage risks, optimize operations, and meet the needs of their customers, while also staying ahead of regulatory requirements. Ultimately, the successful integration of predictive analytics into financial operations will be critical for driving growth and ensuring long-term success in the financial industry.

Trending blogs

5 Factors Influencing Consumer Behavior

READ MOREElasticity of Demand and its Types

READ MOREAn Overview of Descriptive Analysis

READ MOREWhat is PESTLE Analysis? Everything you need to know about it

READ MOREWhat is Managerial Economics? Definition, Types, Nature, Principles, and Scope

READ MORE5 Factors Affecting the Price Elasticity of Demand (PED)

READ MORE6 Major Branches of Artificial Intelligence (AI)

READ MOREScope of Managerial Economics

READ MOREDifferent Types of Research Methods

READ MOREDijkstra’s Algorithm: The Shortest Path Algorithm

READ MORE

Latest Comments

minotverabc876ccb8ac74436

Jun 27, 2023Victim of a BTC Scam? Contact Ultimate Hacker Jerry to recover your Lost Bitcoin. Have you ever been a victim of a scam? or have you Suffered a loss from a Fraudulent Ponzi Scheme? I implore you to Contact Ultimate Hacker Jerry, A Certified hacker and Lost Crypto Recovery Expert. I once fell victim to an online imposter who convinced me to invest in a phoney Cryptocurrency scheme by claiming to have made large profits from the plan. My Trezor wallet contained $219,100 in Crypto that I lost, I had been reporting to the Authorities tirelessly for a longtime without getting assistance before I finally got in touch with Ultimate Hacker Jerry. Fortunately after a serious conversation with Ultimate Hacker Jerry all my funds were recovered back. I recommend this Expert to any victim who has lost Crypto to any fake online Ponzi Scheme.. Get in touch with ULTIMATE HACKER JERRY Through ; Mail (Ultimatehackerjerry@seznam. cz) WhatsAp, (+1,5/20,2827,15,1)

bullsindia1877532969bd7334a57

Jun 30, 2023DO YOU NEED A FINANCIAL HELP? ARE YOU IN ANY FINANCIAL CRISIS OR DO YOU NEED FUNDS TO START UP YOUR OWN BUSINESS? DO YOU NEED FUNDS TO SETTLE YOUR DEBT OR PAY OFF YOUR BILLS OR START A GOOD BUSINESS? DO YOU HAVE A LOW CREDIT SCORE AND YOU ARE FINDING IT HARD TO OBTAIN CAPITAL SERVICES FROM LOCAL BANKS AND OTHER FINANCIAL INSTITUTES? HERE IS YOUR CHANCE TO OBTAIN FINANCIAL SERVICES FROM OUR COMPANY. WE OFFER THE FOLLOWING FINANCE TO INDIVIDUALS- *COMMERCIAL FINANCE *PERSONAL FINANCE *BUSINESS FINANCE *CONSTRUCTION FINANCE *BUSINESS FINANCE AND MANY MORE: FOR MORE DETAILS.CONTACT ME VIA. Contact Our Customer Care: EMAIL: :bullsindia187@gmail.com (CALL/WHATS APP) :+918130061433 Our services... Guaranteed 100%

pacificlanding35095b1ec53f7d94754

Sep 14, 2023I am a private money lender that give out fast cash no collateral required. all cash amounts and currencies, if interested TO started no matter your location (WhatsApp) number +918131026914 or email pacificlanding350@gmail.com Pacific landing Services Mr. Gupta Dwyer.

osmanosmanibrahim0327dd7983c9db1450f

Oct 01, 2023Financing / Credit / Loan We offer financial loans and investment loans for all individuals who have special business needs. For more information contact us at via email: bullsindia187@gmail.com From 5000 € to 200.000 € From 200.000 € to 50.000.000 € Submit your inquiry Thank you

brenwright30

May 11, 2024THIS IS HOW YOU CAN RECOVER YOUR LOST CRYPTO? Are you a victim of Investment, BTC, Forex, NFT, Credit card, etc Scam? Do you want to investigate a cheating spouse? Do you desire credit repair (all bureaus)? Contact Hacker Steve (Funds Recovery agent) asap to get started. He specializes in all cases of ethical hacking, cryptocurrency, fake investment schemes, recovery scam, credit repair, stolen account, etc. Stay safe out there! Hackersteve911@gmail.com https://hackersteve.great-site.net/

reaganpaccof92410a56aeb444d

Dec 05, 2024Recovering From Fake Online Investment Schemes: A1 WIZARD HACKES Is it possible for scam victims to receive their money back from cryptocurrency scam? Yes, if you have been a victim of a fraud from an unregulated investing platform or any other scam, you may be able to reclaim what was stolen from you, but only if you report it to the appropriate authorities. You may reclaim what you’ve lost with the appropriate strategy and evidence. Those in charge of these unregulated platforms would most likely try to persuade you that what happened to your money was an unfortunate occurrence when, in reality, it was a sophisticated theft. If you or someone you know has been a victim of these situations, you should know that there are resources available to assist you. Simply contact A1 WIZARD HACKES. It is never too late if you have the right information your cryptocurrency will be recovered, reach out to A1 WIZARD HACKES Contact Info: E-mail : A1wizardhackes@cyberservices.com whatsssApp : +1 678 439 9760 website : a1wizardhackes.com

susanneklattenloaninvestment589cf0e00f8c4aca

Apr 30, 2025Wise Data Tech Recovery services are truly unparalleled and among the best in the industry. Their expertise and advanced technological capabilities make them the ideal choice for anyone seeking to recover lost or stolen cryptocurrency. With Wise Data Tech by your side, you can rest assured that your crypto assets are in the hands of a highly skilled and trustworthy team. Their remarkable problem-solving skills, combined with their dedication and determination, ensure that no challenge is too great for them to overcome. Wise Data Tech recovery commitment to delivering exceptional results and their genuine desire to help their clients sets them apart from the rest. If you’re in need of crypto recovery services, Wise Data Tech recovery is the perfect partner to navigate the complex world of cryptocurrency and bring back what is rightfully yours. Email : infowisedatatechrecoveryservice@proton.me WhatsApp: +1[641]2190773 https://wisedatatech.online

lefevres684ec1fec55ffe04740

Aug 17, 2025Earlier this year, I lost $90,000 to a crypto investment scam. At first, it felt like a dream opportunity smooth talking “advisors,” polished platforms, and fake testimonials that made everything seem legitimate. I didn’t think I was the type to fall for something like that. But I did. And when the platform suddenly disappeared, so did all of my money. The days that followed were some of the hardest I’ve ever experienced. I felt ashamed, angry, and helpless. I reported the fraud, but everywhere I turned, I was told the same thing: crypto transactions are almost impossible to reverse. I started to accept that the money my savings, years of work was just gone. Then I came across Malice Cyber Recovery. I wasn’t optimistic, but I reached out anyway. They didn’t promise miracles, which I appreciated. Instead, they helped me piece together what happened transaction records, communications, and technical details I would’ve never gathered on my own. The process was slow and honestly exhausting at times, but they stayed with it. Months later, I got the message I never thought I would: a significant portion of the funds had been traced and recovered. I cried. It wasn’t just about the money it was about getting a piece of my life back, and proving to myself that I wasn’t completely powerless. I’m still more cautious than ever, and I’ll never look at online investments the same way. But I’m thankful I didn’t give up and even more thankful that someone out there knew how to help when I couldn’t help myself. Email: malicecyyberrecovery@contractor.net WhatsApp: +61410262541

emilpetrov538cd2aed9e726540c1

Aug 24, 2025It started innocently enough. I was introduced to a cryptocurrency investment opportunity through someone I met in a social media trading group. The person seemed legitimate, knowledgeable, and patient. They even showed screenshots of successful trades, withdrawals, and glowing testimonials from other “investors.” I did some basic research, and everything appeared above board. The platform looked professional. The returns, though high, weren’t entirely unreasonable. So, I started with a small amount. I saw immediate “profits” on the dashboard. Encouraged, I invested more. And more. Eventually, over the course of two months, I had put in everything I had my savings, some borrowed funds, even emergency money I had set aside for my parents’ healthcare. In total: $119,000. Then, one day, I tried to withdraw. Nothing. The support stopped responding. The site kept saying there were “technical issues.” I started Googling the company again and noticed warnings I had missed. Forums, Reddit threads, complaints all about how people had been scammed the same way. My stomach dropped. I had been conned. At first, I was too ashamed to tell anyone. I couldn’t eat. I couldn’t sleep. I couldn’t even look at myself in the mirror. I felt like a failure. I was constantly on edge, paranoid, angry, and deeply depressed. My financial future was shattered, and I had no idea how to even begin recovering. Then I stumbled upon a post about Malice Cyber Recovery in a tech security forum. I was skeptical honestly, I thought it might be another scam. But I was desperate. I read every review I could find. Their team had helped others in similar situations recovering stolen crypto, tracing wallets, even working with law enforcement in some cases. I reached out, not expecting much. But from the very first interaction, something felt different. They didn’t overpromise. They didn’t guarantee miracles. They just listened to everything I had to say. No judgment. No rush. They laid out a clear process, explained how crypto recovery works, and told me exactly what they would need. I felt, for the first time in months, a glimmer of hope. The process was not easy it took several weeks of digging, tracing blockchain transactions, identifying the movement of funds, and preparing reports. But the Malice Cyber Recovery team kept me updated at every step. They were meticulous, professional, and persistent. They worked with a network of ethical hackers and legal consultants to track the movement of my funds across multiple wallets and mixers. And then, one day, I got the email: $119,000 successfully recovered. I broke down crying. To see that balance hit my account again… it felt like waking up from a nightmare. I still can’t believe it sometimes. I genuinely thought the money was gone forever. Malice Cyber Recovery didn’t just help me recover stolen money they gave me back my life. They gave me back my peace of mind, my future, and my self worth. If you’re reading this and you’ve been scammed I know how humiliating and devastating it feels. But don’t give up. Don’t let the scammers win. Reach out to the right people. For me, that was Malice Cyber Recovery Email: malicecyyberrecovery@contractor.net WhatsApp: +61410262541

profsipho8451c81baf25e6842be

Aug 28, 2025I am an international based in South Africa online traditional healer, a spell caster, a spiritual healer, astrologer, a psychic, black magician and a love healing expert, a love spell caster to bring back your lost lover in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, South Dakota,+27735584255